WOMEN

25 to 50 YrsStudies reveal that women are better at managing money. Then why hesitate to invest ?

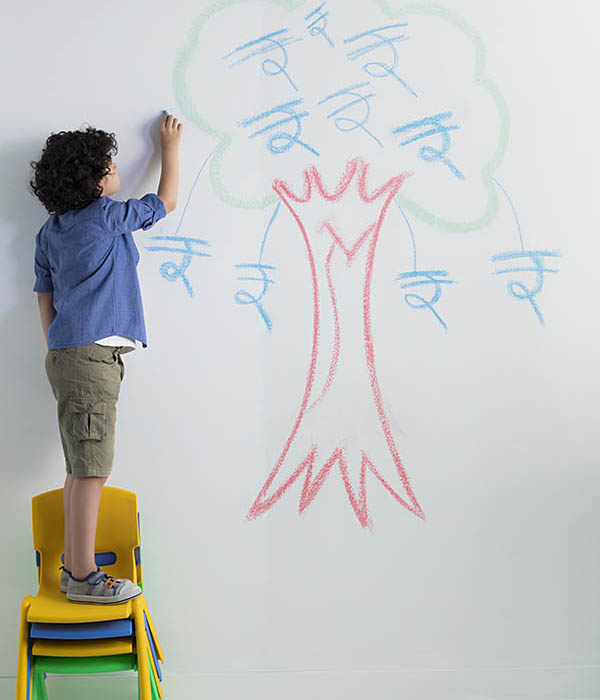

Let's Make Money SimpleKIDS

9 to 12 YrsWarren Buffet made his first investment at 11. When are your children making their ?

Let's Make Money FunTEENS

13 to 19 Yrs"Do you aspire to be rich ? Learn how to make your money work for you"

Get Your Financial GoalsGOLD

50+ YrsPlanning for happy a life after retirement. Make sure you are financially ready.

Find Financial HappinessMoney & Life

From basic needs to the desires of luxury, you can reach your financial goals if you have enough Money,

& hence, Managing Money is the most essential life skill you need to have.

FINtastic is about making you financially confident irrespective of your age, gender & profession.

Here is why, you should join FINtastic, Now!

Must Have Life Skill

A life skill which is a must for all & that defines the whole of your life & lifestyle is managing money.

You Are Never Taught

No school or college ever teaches you the most important life skill of managing money.

Perceived Complexities

Finance may be complex but learning about Money & Finance at FINtastic is Simple, Fun & Exciting.

Make Your Money Work

Make your money work for you & learn to invest for creating wealth which is there for generations.

Programs For All, Designed With Your Specific Learning Needs & Solving Your Financial Learning Pain Points.

FINtastic Learning Programs

Get a free registration

REGISTER NOW

Testimonials

Fintastic Experiences

Vaibhavi Gupta

FINtastic Teen

Money and Financial Planning are one of the most integral and key components to a successful future and to achieving goals, but surprisingly we are never taught that, even in schools. Joining Fintastic Teens was an amazing experience, and the sessions were very informative, fun filled and interesting. It is not just a program, but a lifelong forum, and we can always bring up our doubts or take advice from experienced professionals even after the end of the sessions. It was a really great experience for me, and I would highly recommend it to everyone.

Ms Smriti Goenka

FINtastic Women

Fintastic Women is a well-structured course for finance basics. The instructors are extremely competent, immensely patient and genuinely want to make their students learn and benefit. Highly recommended for women who want to learn to manage their money more effectively.

Ms Preeti Arora

FINtastic Women

I am really glad that I joined this program. I was very comfortable with my bank savings account and FDs but in the first week itself I learned that by just making a few changes in the type of account I can get better rate of interest and. The next week was learning about stocks & mutual funds . We had heard about Nifty, Index but didn’t know much so never thought of investing. But by 3rd week I am confident & looking forward to invest my money in a planned way. Thank you FINtastic team

A brief

About FINtastic

FINtastic is a Social Movement of Making Every Individual Financially Confident.

It's not just a 15 or 20 days program. It's a Life Long Learning. During your FINtastic Learning Program, you learn the concepts and practice in a Virtual Enviornment. What makes it even more unique is that learning doesnt stop there. You become a part of FINtastic Forum, where for the next 1 Year, Finance Coaches and Industry Experts handhold you executing what you have learnt, guide you making right money decisions and multiplying your financial confidence.

50

Coaches & Mentors

500

Yrs of Collective Experience

6

First Level Programs

25

Advanced Programs